The Best Companies Take Advantage of Both

The Best Companies Take Advantage of Both

According to Wikipedia, Big Data is a collection of data so large and complex it becomes difficult to process… However, many companies embrace a different concept of Big Data. While the collection of data is broad, based on a large amount of information and customer feedback, these companies are able to filter through it to understand general customer behavior and trends.

Just this week RetailWire, a daily online publication, posed a question about Big Data versus Little Data. A term not quite as well known, Little Data is a collection of information on an individual or smaller group of customers. Rather than using this data to spot a trend, the company uses the data to customize the customer’s experience.

For example, the manager at a restaurant knows a specific customer’s favorite table. Or a car rental company that knows a particular customer likes a four-door mid-size car. The data or information the company has acquired about the customer is specific.

The company that RetailWire used as an example was Kimpton Hotels, a chain of luxury boutique hotels that understands the power of Little Data. Their concept is to focus on the individual guest versus their customer group as a mass. Any company will make decisions about their business based on general feedback and trends. However, successful companies recognize that customers are not numbers or anonymous groups of people. Those successful companies zero in on individual customer’s needs, preferences, likes and dislikes and attempt to give the customer an experience that is exactly what he or she wants.

What’s the payoff? For the Kimpton Hotels chain it was some of the highest satisfaction rates in their industry. They earn their customers’ repeat business with highest loyalty and emotional attachment of any hotel chain in the United States. They are successful because they know who they are as a brand and who they want as a customer. Because of Big Data, they know the typical guest who stays at their hotels. And, once the guest is there, they have a system that takes advantage of Little Data and allows the onsite employees to individualize the guest’s experience.

Big data gives you trends to make major decisions. Little Data gives you information to keep your best customers coming back. It’s that simple. The question is really about whether or not a company is willing to invest in the technology to track and recognize customer preferences that fall within an acceptable range, and then are willing to train their people to deliver an experience based on this information.

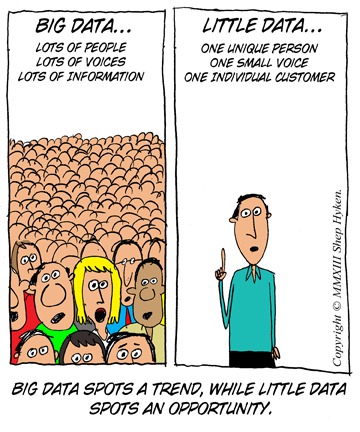

Another way of saying this: Many voices, or Big Data, may say the same thing and spot a trend. A few voices, or Little Data, may say something different and spot an opportunity. The best companies take advantage of both!

Companies that can take big data and "little data” and combine it to create personalized customer experiences will come out on top.

In banking, much of that bid data and little data is capture each time one of your customers interacts with you whether it's in person, at the ATM, over the phone, or via a digital channel. The challenge comes in breaking down the technology silos to get at that information so you can use it effectively. We hear about this challenge every day from our clients and prospects.

Personetics has developed a robust solution specifically for the banking industry that accesses existing customer data and looks at individual customer profiles and past behaviors (little data) as well as crowd behavior and trends (big data) to predict why the customer is contacting the institution. Combining all that data and giving customers a fantastic experience every time – no matter what channel they choose – will build that trust and loyalty every company needs to flourish.

FIs that use big data and little data effectively will be able to deliver that superior banking experience over and over again.

This article really resonates with me. The danger of Big Data is the loss of the Voice of the (Individual) Customer and the effort that Kimpton puts into empowering their employees to address that customer on that level is impressive. The Big Data proponents must continue to keep the Person as the end focus.

Thank you Jeff – Well said. “The Big Dada proponents must continue to keep the person as the end focus.” For most, if not all, businesses, customers must be treated like individual people – not numbers or as a group.

Thank you, Deborah, for your kind words about the article. Glad that it resonated with you. As business has access to more technology and more data, we can’t lose the voice of the individual customer.

Jeff, thank you for sharing this great information.

Your focus on the importance of “little data” to enhancing the individual

customer experience, and thereby satisfaction and retention, translates well

into Human Resources.

I encourage every organization to treat employees with this same “little

data” focus. Employees want meaningful recognition and rewards. Often times,

a simple, no cost, “thank you” would save thousands of dollars (and paper

weights), and improve employee happiness, productivity and retention.

Understanding what motivates individual employees to achieve strategic and

operational results is critical to retaining key talent. Designing a

flexible total rewards strategy for employees should go hand-in-hand with

building a world-class customer experience.

Lissa, you are so right. Recognizing employees and saying, “Thank you!” is so much appreciated. And, appreciation is one of the best ways to get employees engaged, which directly benefits the customer.