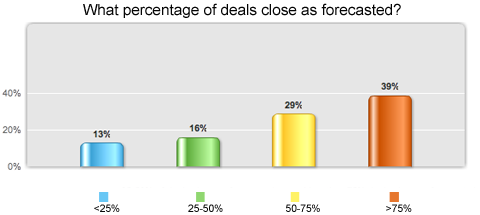

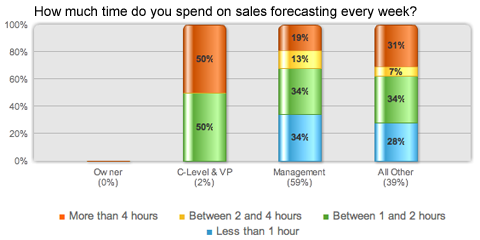

If I told you that everyone in your sales organization spends up to 2.5 hours each week on a task that is worthless – or indeed, the results of which, costs the company money – what would you say? I guess you’d be pretty outraged. Surely, that time and money could be better spent in activities that might smooth some of the bumps in the road that sales professionals have to deal with every day. Well, for the majority of organizations, the scenario I’ve painted here is unfortunately all too true. Looking across more than 200 companies, we’ve established that sales people spend about 2.5 hours each week on sales forecasting, and for most companies, the forecasts are less than 75% accurate. When success or failure is usually measured in margins far less than 25% – these forecasts are truly worthless.

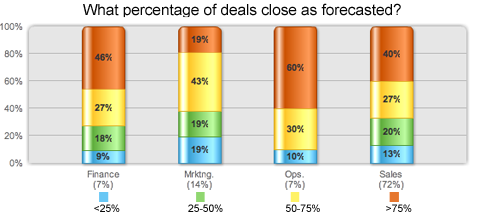

Analyzing the results in a little bit more detail, the situation is really very serious from an organizational perspective, as there is a very significant discrepancy across the functional departments as to the perceived accuracy of forecast data. The consequence is very expensive. Resource planning is impossible to do correctly when (a) the forecasts are inaccurate, and (b) when the level of confidence in the projections varies widely. Imagine if marketing is responsible for predicting demand, operations own the product delivery, and finance is accountable for capital spending to support the product roll-out. Where misalignment prevails, profitability suffers.

And what about the actual time spent in creating the sales forecasts? We all know that sales forecasts are not purely the purview of the sales function. The sales person first makes his estimate, who then discusses (or, in truth negotiates) the number with his manager. She then further massages the number, factoring in what she has learned about the ‘usual accuracy’ of the individual, and passes the modified result on to her manager, who will then inform finance and operations for business and delivery planning. The results of our analysis would suggest that each sales forecast is handled by many different individuals, and in reality each deal is subject to multiple levels of scrutiny before someone finally determines whether it should be forecasted or not.

What’s the actual direct cost of this unproductive exercise? If we just limit our calculations to the sales function we can perhaps make a reasonable estimate. In the United States there are approximately 20 million people who classify themselves as sales people. To be ultra-conservative, I’m going to assume that only half of these have any role in forecasting. I will further assume that the average loaded cost of each sales person is $100,000 (spanning entry level to executive grades). Based on an average weekly effort of 2.5 hours per person, that would suggest that the US economy spends in excess of $50Bn on sales forecasts that just don’t work.

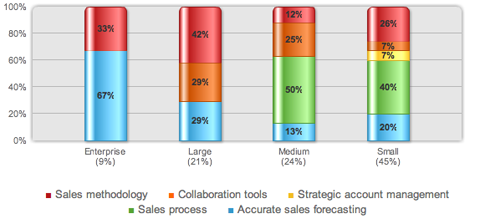

It’s no surprise therefore that when asked what’s missing from CRM, enterprise- and large-size companies (the main users of CRM systems) named ‘Accurate sales forecasting’ as one of their top two requests. And yet, CRM companies don’t respond. In fact, most of the large CRM companies don’t use their own systems for forecasts. (Quick tip: Look in your own CRM system, or ask your CRM vendor to look in theirs, and look for open sales opportunities that are forecasted to close in the past – an impossibly result. The answer will depress you – but, will at least, illuminate the problem.)

But it doesn’t have to be this way. As you may know, my company, The TAS Group, is involved in sales performance automation solutions (Dealmaker) that combines intelligent sales methodology, process and technology to help sales teams sell better, and gain more accurate sales forecasts. I’m clearly biased, and have a vested interest in highlighting this problem. However, that’s not the only reason why I’m writing about this. Like you, I care about the economic recovery, and the productivity loss that accompanies this sales forecast problem doesn’t help any of us.

So, it’s time to stand up and “Ask not what you can do for your CRM, but what your CRM can do for you.”

P.S. I’ve written about this and related matters here, here and here and there are two related videos you might enjoy that you can find here (look for the forecast analysis video) and here .

In my experience, the primary problems with forecasts are that:

1. Salespople provide all the raw data (and they are ill-equipped to provide objective input — and often incentivized not to!)

2. In high-dollar-value / low-throughput environments, the standard forecasting methodology is non-sensical — a 50% probability of winning a $1m deal next month cannot be treated as $500k in expected revenue!

I provide a (scenario-based) alternative in the article linked above — and that article starts with a link to my critique of forecasting.

Justin